Avoiding Burnout When You Work in Human Resources

If you work in human resources, you know that employee burnout remains pervasive. You also kow that the task of supporting overly stressed employees often falls on your shoulders. But you're exhausted too. Burnout isn't just a problem you have to help others solve; you also have to solve it for yourself. Here are size ways to help you avoid burnout.

Set Boundaries

Place boundaries around both the time during which you work and what you spend your time doing while working. If you say that you're done with work at 6 p.m., don't do any work after that time. Emails and Slack messages can wait until the next workday. If people at work need to be able to reach you in an emergency, establish a specific way for that to happen (e.g., a call or text to your cell) and make sure the people who may contact you know what qualifies as an emergency and what doesn't.

You can set boundaries during the workday by delegating tasks that don't need to be done by you. HR is a big job for one person or even one department. Not every personnel issue even should be handled by you. Managers and department heads should be able to handle a lot of those issues themselves, and only come to you for help if it's actually needed. If they are bringing you so many small problems that you don't have time to resolve the big ones, you may need to set different expectations or train managers to resolve certain issues themselves.

Know What You Can and Cannot Control

In HR, we often feel responsible for everything related to employees. If there’s an issue, it’s on us to address it. A problem? We own the solution. Something not improving? We’re at fault. This belief that we are responsible for all the things causes stress to mount and leads to burnout. It also isn’t true.

We can’t be responsible for what we can’t control, and so much that happens in the workplace is simply out of our control. It’s vital—both for our work and our mental health—for us to know what is and isn’t in our power to change. If employees are quitting as a result of ineffective workplace policies, and you have purview over those policies, you can probably do something about this attrition. But if they’re quitting because there are better opportunities for them that your organization can’t match, there may be nothing you can do. Spending time trying to solve unsolvable problems isn’t going to have a good return. Or, as the old saying goes, if there is no solution, there is no

Train Your Colleagues

Being the only one who can do a certain essential task may be good for your job security, but it isn’t good for your health. If no one else can do what you do, you can’t truly get away or be guaranteed to focus on one task to the exclusion of all others. People can only cover for you if they have the knowledge and skills to complete the tasks you need covered.

Realistically, you can’t plan for every contingency, but teaching colleagues the skills and knowledge they’d most likely need when covering for you increases the likelihood that they’ll be able to handle whatever arises while you’re away or focused on an urgent project.

Implement Clear and Simple Policies and Practices

The more ambiguous or complex your workplace policies and practices are, the more questions people will have about what they mean or require. If you find that your people often come to you asking what they’re supposed to do in a given situation, look at what you can do to answer their questions proactively. Do you have an employee handbook? Standardized practices for managers? Granted, some employees aren’t going to read any policy documents you give them, but in general you can save yourself (and others) a lot of time by defining policies and practices so that they are clear, accessible, and easy to follow. Accordingly, you should ensure that leaders are aware of where the handbooks, policies, and guidelines reside so that employees may self-serve whenever possible.

Take Time Off

Speaking of getting away, take time off. You need a break from work as much as anyone—maybe more so—and you don't need to justify it. You don’t have to feel sick or especially overwhelmed or have something special planned. Breaks from work are good for you, period. If you feel the need to justify a break from work, take time off to set a good example to everyone else that they should be taking time off too.

When employees see leaders in their organization taking ample time away from work, they feel more confident taking time off themselves. That helps save those employees from burnout, which in turn saves their leaders’ time

Connect with Other HR Professionals

Working in HR can be a lonely profession, especially if you’re a department of one. When you’re in HR, friendships at work range from tricky to ill-advised. You may not have anyone at work you can really open up to or who appreciates the challenges of your job. Fortunately, there’s an active community of HR professionals online who are more than happy to share ideas, answer questions, or just listen. You can find them on LinkedIn, Twitter, and elsewhere by searching #hrcommunity or #hr. They’re a friendly and chatty bunch, eager to converse about the latest trends, specific pain points, and the generally daunting challenges of working in HR.

Consider following a few HR practitioners, participating in a conversation, or just watching from the sidelines until you feel more comfortable. It’s not quite the same as having a close friend at work, but what it lacks in close proximity, it makes up for in shared experience.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Federal Law Alert:

OSHA Releases Emergency Temporary Standard on Vaccination and Testing

OSHA released its Emergency Temporary Standard (ETS) requiring COVID vaccination or testing for employees of employers with 100 or more employees.

Creating a Safe and Fulfilling Workplace for Another Challenging Year

As we enter the new year, the riss of COVID-19 may recede, but the trauma, pain, and disruptions of these past two years will still be with us, affecting our lives and our work. We've all struggled, sometimes in ways we can't pinpoint.

In her book Bearing the Unbearable, Joanne Cacciatore describes grief as "a process of expansion and contractoin." Cacciatore explains that in a moment of contraction, we may feel unsteady and unsafe, and we "feel the call to self-protect." In a moment of expansion, we "become more willing to venture out and explore" and "take risks". This process isn't exclusive to grief, of course. Watever the cause, many of us right now are experiencing one or the other, or both.

A recent guest on the HR Social Hour Half Hour Podcast, Julie Turney, founder and CEO of HR@Heart Consulting, observed that people today recognize that they deserve better, and they are demanding better. They are less willing to settle, less comfortable with the way things are. People are fleeing jobs that are physically or psychologically unsafe. Others are chasing their dreams with newfound passion.

For the foreseeable future, people will seek environments that are both flexible and strong enough to support a process of contraction and expansion. They will desire work that gives them a safe place to be and a fulfilling place to go. They will crave a future they can own and a course they can chart, and their jobs will either help or hinder them. Jobs that help them will be in high demand.

Fortunately, such sought-after work environments can be achieved with some basic practices. Let's look at some.

Talk About the Future

Ask your managers to talk regularly with their direct reports about how they're feeling today and what they'd like to be doing in the future. Due to the circumstances, you can expect the answers they hear to vary and to change. On a given day, an employee may feel optimistic and ambitious, eager to take on a new project or a new role. But a week later, that same employee may feel hesitant or anxious about taking on any new responsibilities.

Don't assume an employee expressing conflicting feelings isn't up for the task at hand. In normal times, it's nautral to second guess big decisions, and these are not normal times. Some employees may need a little extra encouragement. Others may truly be happier continuing to do what they've been doing.

Through these conversations, managers can healp their people make informed decisions about their future that make sense for them and for the company.

Don't be Afraid to Set Deadlines

Giving employees time to decide what future makes the most sense for them can go a long way to building trust and gratitude. There will come a time, however, when a decision needs to be made. A manager who has been talking with a member of their team about a new career opportunity in another part of the company, for example, will need a definitive answer eventually, probably sooner rather than later.

When a manager has a conversation with a team member about opportunities for growth that require significant change, they should, as soon as possible, make it clear to the employee when a final decision needs to be made. That way the employee has a set timeframe to work through their feelings, and a deadline isn't unexpectedly thrust upon them.

Provide Grief Support

A lot of people are grieving, and grief takes work. People grieving need the time, space, and freedom to do that work. The option to take bereavement leave after loss can be invaluable to them, but so too is the liberty to take days off down the road when they're needed. The grieving process isn't linear, and the unbearable pain of grief can resurface unexpectedly, months and years later. The life of grief is long.

Whatever you can do to enable employees to safely take the time they need to process a loss and heal, do it.

Take Care of Yourself & Your HR Leaders

Lars Schmidt, founder of Amplify, points out that, while the "market for HR roles has never been hotter", the work of HR has taken a "sustained toll" on those doing that work. They're "carrying the emotional burdens of their employees (and their own)." Burnout is common.

Be sure to give yourself and anyone else caring for your people time to rest, recharge, grieve, or whatever else each of you needs to do to stay healthy. "Resilience is not an infinite resource," executive coach Sarah Noll Wilson reminds us. Take time off. You need it, too.

Don't Take Departures Personally or Draw the Wrong Conclusions

When an employee leaves an organization, it's always a good idea to understand why and consider what changes you could have made to keep them. what you learn may not persuade that employee to reconsider their departure, but it may assist you in keeping others. That said, sometimes employees quit and there's nothing you could have done to convince them to stay. The best possible workplace in the world will still see people go elsewhere simply because those people want to change or because of circumstances beyond their control.

When your employees tell you they're leaving, do you due diligence to find out why, but don't overthink their departures or take them personally. If everything was good and they still left, that just means everything was good and they still left. It doesn't mean that you didn't do enough or should have done something differently. Believe in the work you're doing. Be kind to yourself. As Lars Schmidt says in his book Redefining HR, "we're on the front lines of the highest of highs and the lowest of lows of all our employees."

Inspire Hope

Whether we feel the strong urge to self-protect or we're jumping out of our seat to pursue a risky venture, we could all use a little hope. The philosopher David Utsler writes, "Hope offers no guarantees. Hope does not promise that life or the world will get better. Hope only insists on the possibility."

You can inspire hope by expanding the scope of what is possible for your employees. Talk with them about their dreams and ambitions so they can imagine what possibilities lie before them. Talk about where your company is going and what you'll need from your employees. Help them envision a place where they can explore, take risks and be supported.

Then work together to get there.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

When You Need to Hire Workers, But Nobody Likes the Work

Some jobs are just plain unpleasant. You know the type. Monotonous tasks that don't end until it's time to clock out. Dealing all day with customers who are unhappy. Fielding nonstop complaints. Hard labor. Outdoor work in extreme temperatures. You can convince people to take these jobs when they have no other choice. But right now, for a variety of reasons, they do have other options. The avoidance of undesirable work is one reason why half of all small businesses are unable to find workers right now. Pay raises and other perks haven't always done the trick either. This has left many employers with no good way to incentivize job seekers to apply or convince dissatisfied employees to stay. After all, the work is the work, and there's nthing to be done about it, right? Not necessarily.

Employers have some control over what the work is, how it's done, and under what conditions it's done. Not limitless, of course, but there often are ways to make unpleasant work more bearable, if not genuinely exciting. If you're among the half f small businesses struggling to fill positions, and you haven't had any luck with other measures to entice applicants to apply, consider what changes you could make to the work you need done or to the overall wrk experience at your business. Here is a set of steps you could follow:

American Rescue Plan Act COBRA Notices

Model General Notice and COBRA Continuation Coverage Election Notice

For use by group health plans for qualified beneficiaries who have qualifying events occurring from April 1, 2021 through September 30, 2021.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Three Questions About COVID Vaccinations

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Employees Want More- Can You Offer It?

Greater Freedom & Flexbility

Most employees who have experienced the benefit of working from home want remote work to remain an option, at least part of the time. Some appreciate being able to pick up kids from school, take a midday exercise break, or use the bathroom without anyone tracking how much time they're spending away from their workstation. Others feel relieved to have escaped a workplace marked by harassment or microaggressions. Still others enjoy using their commute time for something personally rewarding or for getting work done.

But remote work isn't the only way that employees desire greater freedom and flexbility. They also want the liberty to decide their own work schedule or at least receive their schedule in advance, the option to take time off when they need it and without worrying about a smaller paycheck, and ample opportunties to advance their career.

A Bigger Say in the Workplace

When employees at Google announced the creation of a minority union early this year, a lot of people were taken by surprise. After all, tech employees aren't exactly known for unionizing, and Google is known for being a great place to work. Some of the union's goals are what you'd expect- fairer wages and more protection from harassment and retaliation. But the union also seeks to influence how the company conducts business- and with whom. Its members want a say in how their labor is used. "As a tech employee, it's a reasonable ask to ensure that this labor is being used for something positive that makes the world a better place," one employee told NPR.

Employees at our tech companies feel similar. Two employees at Amazon resigned in protest recently after hundreds of employees unsuccessfully petitioned the company to stop selling a book that they said framed transgender identity as mental illness.

What these employees want is cultural fit. They want their work and their workplace to align with their beliefs and values. They're willing to leave if the culture doesn't suit them, but they also believe the culture isn't only the employer's to define. As they see it, the culture belongs to them, too. And some of them will organize protests, perform walkouts, and engage in other forms of concerted activity in an effort to influence the culture.

Tip: Consider whos values take priority in your workplace. Does culture come from the top down or is it a collaborative effort? If employees don't feel comfortable expressing their opinions about what the culture is and what it should be, what could you do to reassure them and encourage fruitful discussions?

Increased Safety & Security

The COVID pandemic has shined a painfully bright light on workplace health and safety practices- or lack thereof. COVID-related risks and violations abound. According to a study from the University of California, San Francisco, five professions saw an increase in mortality rate higher than 50 percent: agricultural workers, bakers, constructino laborers, line cooks, and line workers in warehouses were most at risk.

With health and safety on most people's minds, there's a big demand for work that's physically and mentally healthy. Most employees don't want a job that puts them in danger of getting a serious illness or causes them psychological harm. Workers want to feel safe, and they're leaving jobs where they don't.

Tip: Following all recommended safety precautions is a lot to keep track of, but it's also just the bare minimum. Make sure your employees also feel safe- physically and psychologically. Listen to any concerns they have and do what you can to address them.

Better

Compensation

The desire for higher pay, additional benefits, on-th-job training, and financial relief are by no means new. But right now, in certain industries, employees have the leverage to demand better compensation. In response, employers in these industries are advertising signing bonuses, $15 an hour minimum pay, and other attractive forms of compensation.

Tip: Develop a compensation strategy that's responsive to fluctuating costs of labor.

News Brief

The American Rescue Plan Act

The American Rescue Plan Act (ARPA), which is the latest bill to address the ongoing economic impacts of COVID-19, has been signed into law. Most aspects of the law do not directly affect the HR function, but two of those that do—optional extension of sick and family leave and establishment of COBRA subsidies—are outlined below.

Optional Extension of Sick and Family Leaves

Part of ARPA is an extension of the current tax credit scheme for Emergency Paid Sick Leave (EPSL) and Emergency Family and Medical Leave (EFMLA) under the Families First Coronavirus Response Act (FFCRA). The FFCRA required many employers to provide EPSL and EFMLA in 2020, but became optional when it was previously extended to cover January 1 through March 31, 2021.

The new extension under ARPA takes effect April 1, 2021, and lasts through September 30, 2021. Like the current version, it remains optional. In addition, tax credits are available but only to employers with fewer than 500 employees and up to certain caps. To receive the tax credit, employers are required to follow the original provisions of the FFCRA. For example, they can’t deny EPSL or EFMLA to an employee if they’re otherwise eligible, can’t terminate them for taking EPSL or EFMLA, and have to continue their health insurance during these leaves.

Reasons for Using EPSL and EFMLA

Starting on April 1, employees can take EPSL or EFMLA for the same set of reasons, which is a useful simplification. The following are acceptable reasons for taking these leaves:

- When quarantined or isolated subject to federal, state, or local quarantine or isolation order

- When advised by a health care provider to self-quarantine because of COVID-19

- When the employee is experiencing symptoms of COVID-19 and seeking a medical diagnosis; seeking or awaiting the results of a diagnostic test for, or a medical diagnosis of, COVID-19 because they have been exposed or because their employer has requested the test or diagnosis; or obtaining a COVID-19 vaccination or recovering from any injury, disability, illness, or condition related to the vaccination

- When caring for another person who is isolating or quarantining on government or doctor’s orders

- When caring for a child whose school or place of care is closed due to COVID-19

Employees and employers will—in most cases—want to exhaust EPSL first, since it has a higher tax credit, except when used to care for others.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Emergency Paid Sick Leave (EPSL) Changes

Here are the key changes to EPSL, in effect from April 1 through September 30, 2021:

- Employees can take EPSL to get the COVID vaccine and to recover from any related side effects.

- Employees can take EPSL when seeking or waiting for a COVID-19 diagnosis or test result if they’ve been exposed to COVID-19 or if the employer has asked them to get a diagnosis or test. (Previously, time spent waiting on test results was not necessarily covered, which seemed like an oversight.)

- Employees will be eligible for a new bank of leave on April 1. Full-time employees are entitled to 80 hours while part-time employees are entitled to a prorated amount. Unused hours from before April 1 will not carry over.

- Employers can’t provide EPSL in a manner that favors highly compensated employees or full-time employees or that discriminates based on how long employees have worked for the employer. (Be aware that any inconsistencies in the granting of leave could potentially lead to a discrimination claim.)

Tax Credit

Review

The tax credits available between April 1 and September 30 are the same as under the original FFCRA, except for the increased aggregate cap for EFMLA. Tax credits are available as described below, regardless of how much EPSL or EFMLA an employee used prior to April 1.

- The credit available for EPSL when used for reasons 1, 2, or 3 (self-care) is up to 100% of an employee’s regular pay, with a limit of $511 per day.

- The credit available for EPSL when used for reasons 4 or 5 (care for another) is up to 2/3 of an employee’s regular rate of pay, with a limit of $200 per day.

- The credit available for EFMLA for any reason is up to 2/3 of an employee’s regular pay, with a limit of $200 per day and a cap of $12,000 per employee.

Employers can also claim a credit for their share of Medicare tax on the employee’s wages and the cost of maintaining the employee’s health insurance (qualified health plan expenses) during their absence.

Emergency Family Medical Leave (EFMLA) Changes

Here are the key changes to EFMLA, in effect from April 1 through September 30, 2021:

- EFMLA can now be used for any EPSL reason, in addition to the original childcare reasons. This includes the two new EPSL reasons noted above.

- The 10-day unpaid waiting period has been eliminated.

- The cap on the reimbursable tax credit for EFMLA has been increased to $12,000 (from $10,000). This applies to all EFMLA taken by an employee, beginning April 1, 2020. This change accounts for the additional 10 days of paid time off—the daily cap of $200 remains the same.

- The law isn’t clear as to whether employees are entitled to a new 12-week bank of EFMLA. We anticipate that the IRS, DOL, or both will provide guidance on this question soon. It is possible that an employee will be entitled to additional unpaid protected time off, even if they already received the maximum reimbursable amount during previous EFMLA leave(s). We will update our materials if and when new information is available.

- Employers can’t provide EFMLA in a manner that favors highly compensated employees or full-time employees or that is based on how long employees have worked for the employer. (Again, be aware that any inconsistencies in the granting of leave could potentially lead to a discrimination claim.)

COBRA

Subsidies

Another important aspect of the law employers should understand is the creation of COBRA subsidies.

Employees and families enrolled in the employer’s group health plans may lose coverage if the employee’s work hours are reduced or employment is terminated. They can elect to continue coverage under COBRA, but the high premium cost can make it difficult to afford this coverage.

ARPA provides a 100% COBRA subsidy if the employee’s work reduction or termination was involuntary. The subsidy applies for up to six months of coverage from April 2021 through September 2021 (unless the individual’s maximum COBRA period expires earlier).

For group plans subject to the federal COBRA rules, the employer will be required to pay the COBRA premium but then will be reimbursed through a refundable payroll tax credit.

Employers with fewer than 20 workers usually are exempt from the federal COBRA rules, but their group medical insurance plans may be subject to a state’s mini-COBRA law. In that case, it appears the subsidy will be administered by the carrier. The carrier will pay the premium and then be reimbursed by the government.

Employers will need to work with their group health plan carriers and vendors on how to administer the new subsidy provision. Although it takes effect April 1, 2021, employees who were terminated earlier but are still in their COBRA election window also are included. Federal guidance is expected to be released by April 10, including model notices that plans can tailor for their use.

Note that the COBRA subsidy doesn’t apply during FFCRA leaves because employees are entitled to maintain their health insurance during those leaves on the same terms as though they had continued to work.

9 Compliance Requirements to Consider for a Remote Workforce

According to Gallup, the number of days employees are working remotely has doubled during the pandemic. Some companies are even considering making a remote work arrangements permanent. While there are no laws that exclusively apply to remote workplaces, remote work does come with additional compliance risks. Below is our general guidance for employers.

Logging Hours & Preparing Paychecks

Make sure that employees are logging all of their time. Keep in mind that when working from home, the boundaries between work and home life are easy to blur. Employees may be racking up “off the clock” work, and even overtime, that they aren’t being paid for. While this may seem harmless enough in the moment, particularly if the employee isn’t complaining, unpaid wages can come back to bite you once the employee is on their way out the door.

Minimum Wage

Employees should be paid at least the minimum wage of the state where they physically work, whether this is a satellite office or their own home. Beyond that, it’s important to be aware that some cities and counties have even higher minimum wages than the state they are located in. In general, with most employment laws, you should follow the law that is most beneficial to the employee.

Breaks

Remote employees must take all required break and rest periods required by law, as if they were in the workplace.

Harassment Prevention Considerations

You may have employees working in a state that has a lower bar for what’s considered harassment or that requires harassment prevention training. You can find this information on the State Law pages on the HR Support Center.

Remote work also comes with additional opportunities for harassment (even if it doesn’t rise to the level of illegal harassment) such as employees wearing clothing that crosses the line into inappropriate, roommates in the background unaware that they are on camera, or visible objects that other employees may consider offensive. You can prevent these sorts of incidents by having clear, documented expectations about remote meetings, communicating those expectations to your employees, and holding everyone accountable to them. It also wouldn’t hurt to occasionally remind everyone to be mindful that they and what’s behind them are visible to coworkers when they’re on video. That said, going overboard with standards that you’re applying to employees’ private homes can cause anxiety and morale issues, so make sure your restrictions have some logical business-related explanation.

Workplace Posters

Many of the laws related to workplace posters were written decades before the internet, and so their requirements don’t always make sense given today’s technology.

The safest option to ensure you’re complying will all posting requirements in one fell swoop is to mail hard copies of any applicable workplace posters to remote employees and let them do what they like with the posters at their home office. If you have employees in multiple states, you should send each employee the required federal posters, plus any applicable to the state in which they work.

Alternatively, more risk-tolerant employers often provide these required notices and posters on a company website or employee self-service portal that employees can access. A number of newer posting laws expressly allow for electronic posting, but this option is not necessarily compliant with every posting law out there.

FMLA Eligibility

Remote employees who otherwise qualify will be eligible for leave under the federal Family and Medical Leave Act (FMLA) if they report to or receive work assignments from a location that has 50 or more employees within a 75-mile radius.

According to the FMLA regulations, the worksite for remote employees is “the site to which they are assigned as their home base, from which their work is assigned, or to which they report.” So, for example, if a remote employee working in Frisco, TX, reports to their company’s headquarters in Portland, OR, and that site in Portland has 65 employees working within a 75-mile radius, then the employee in Frisco may be eligible for FMLA. However, if the site in Portland has only 42 employees, then the remote employee would not be eligible for FMLA. The distance of the remote employee from the company’s headquarters is immaterial.

Verifying I-9's

In normal circumstances, the physical presence requirement of the Employment Eligibility Verification, Form I-9, requires that employers, or an authorized representative, physically examine, in the employee’s physical presence, the unexpired document(s) the employee presents from the Lists of Acceptable Documents to complete the Documents fields in Form I-9’s Section 2.

However, in March, the Department of Homeland Security (DHS) temporarily suspended the physical presence requirement for employers and workplaces that are operating remotely due to COVID-19 related precautions. In other words, employers with employees taking physical proximity precautions due to COVID-19 (and operating remotely) are not required to review the employee’s identity and employment authorization documents in the employee’s physical presence. Inspection should instead be done remotely. As of the date of this newsletter, this temporary rule is still in effect.

Equipment

n some states, an employer is required either to provide employees with the tools and items necessary to complete the job or to reimburse employees for these expenses. However, workstation equipment like desks and chairs is usually not included in this category of necessary items.

That said, an employee might request a device or some form of furniture as a reasonable accommodation under the Americans with Disabilities Act (ADA) so they can perform the essential functions of their job. In such cases, you would consider it like any other ADA request. Allowing them to take home their ergonomic office chair, for example, would probably not be an undue hardship and therefore something you should do.

Deciding Who Can Work from Home

You may offer different benefits or terms of employment to different groups of employees as long as the distinction is based on non-discriminatory criteria. For instance, a telecommuting option or requirement can be based on the type of work performed, employee classification (exempt v. non-exempt), or location of the office or the employee. You should be able to support the business justification for allowing or requiring certain groups to telecommute.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

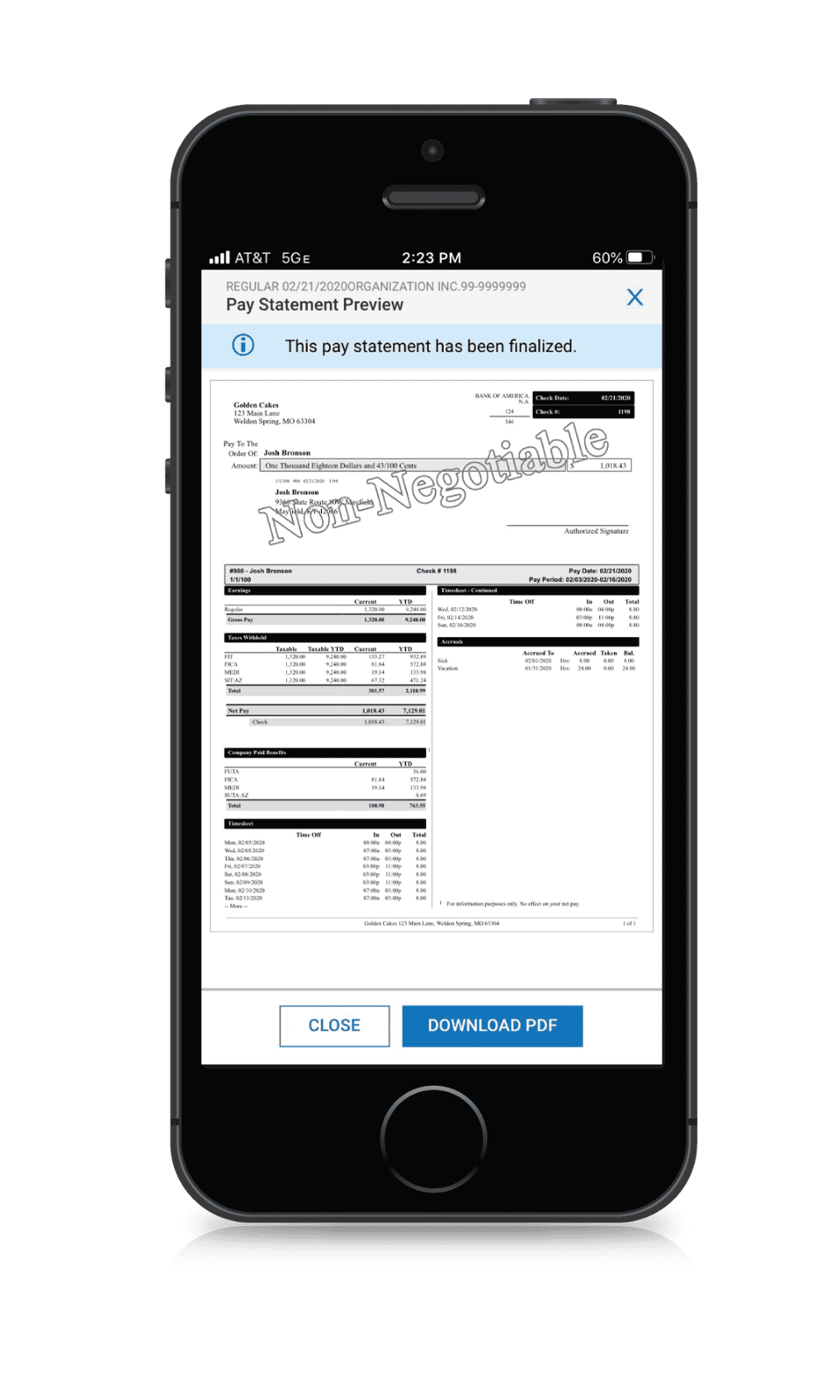

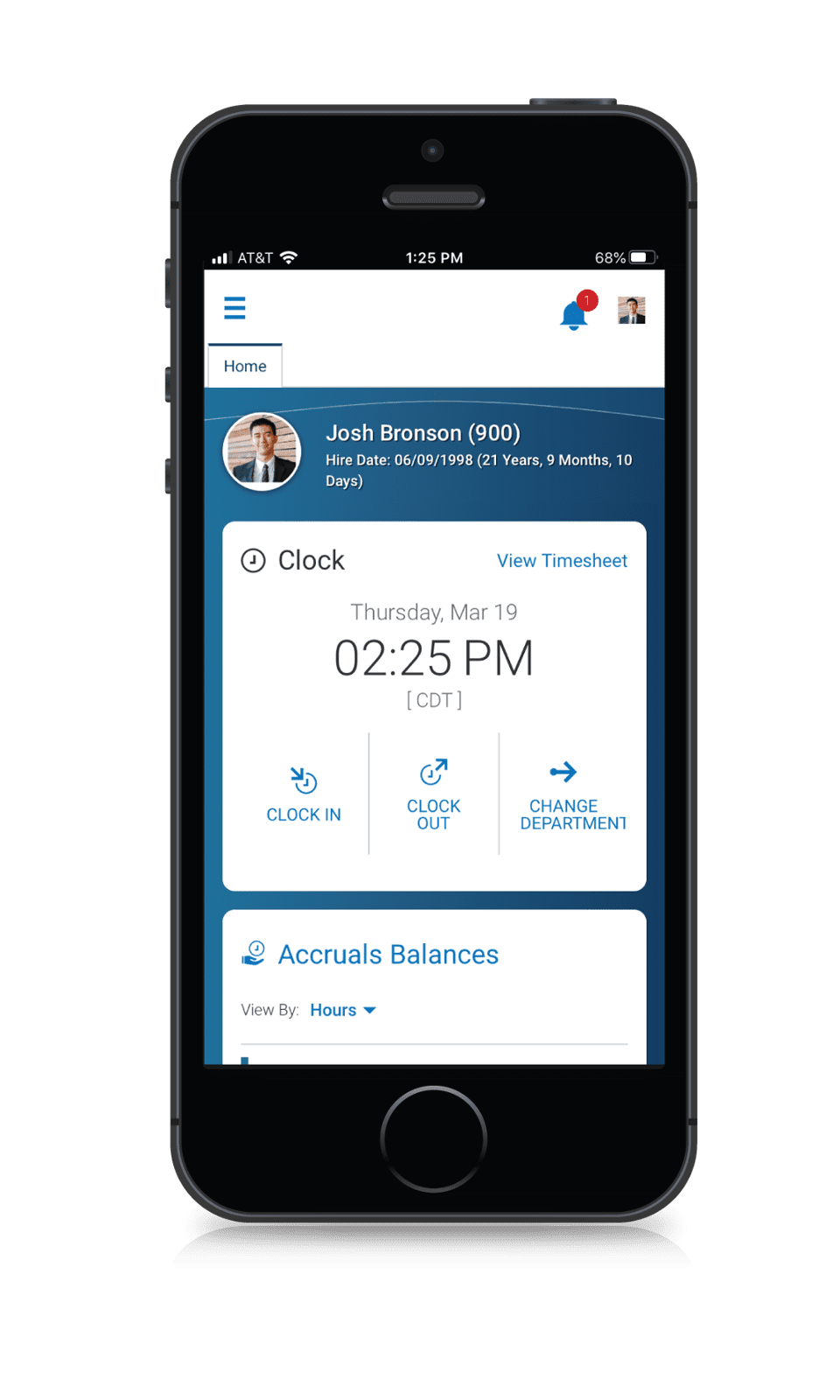

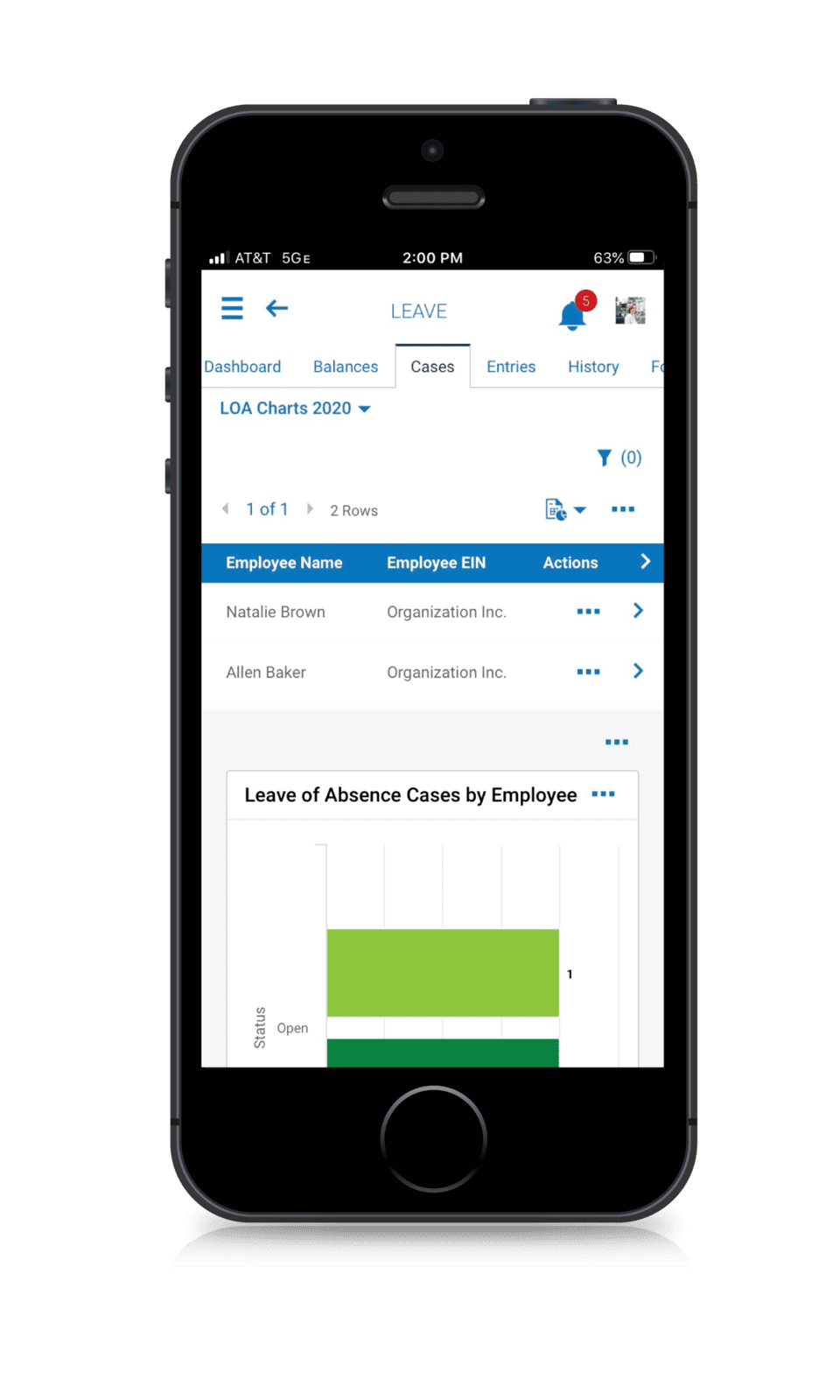

Take Your Workforce Paperless

Take Your Workforce Paperless

Employee Self Service & Direct Deposit

From simple direct deposit and access to pay stubs/history, to control over withholding and address changes, employees have the information they need from anywhere.

Time and Accrual Management Tools

Collect employee time, develop intuitive schedules and approve/reject/modify time-off requests. Managers will have the information they need to still have visibility into their teams day.

Leave of Absence Requests & Tracking

Automate the administration and tracking of paid and unpaid federal, state, and employer-specific leave policies by leveraging a module dedicated to leave cases, tracking and reporting.

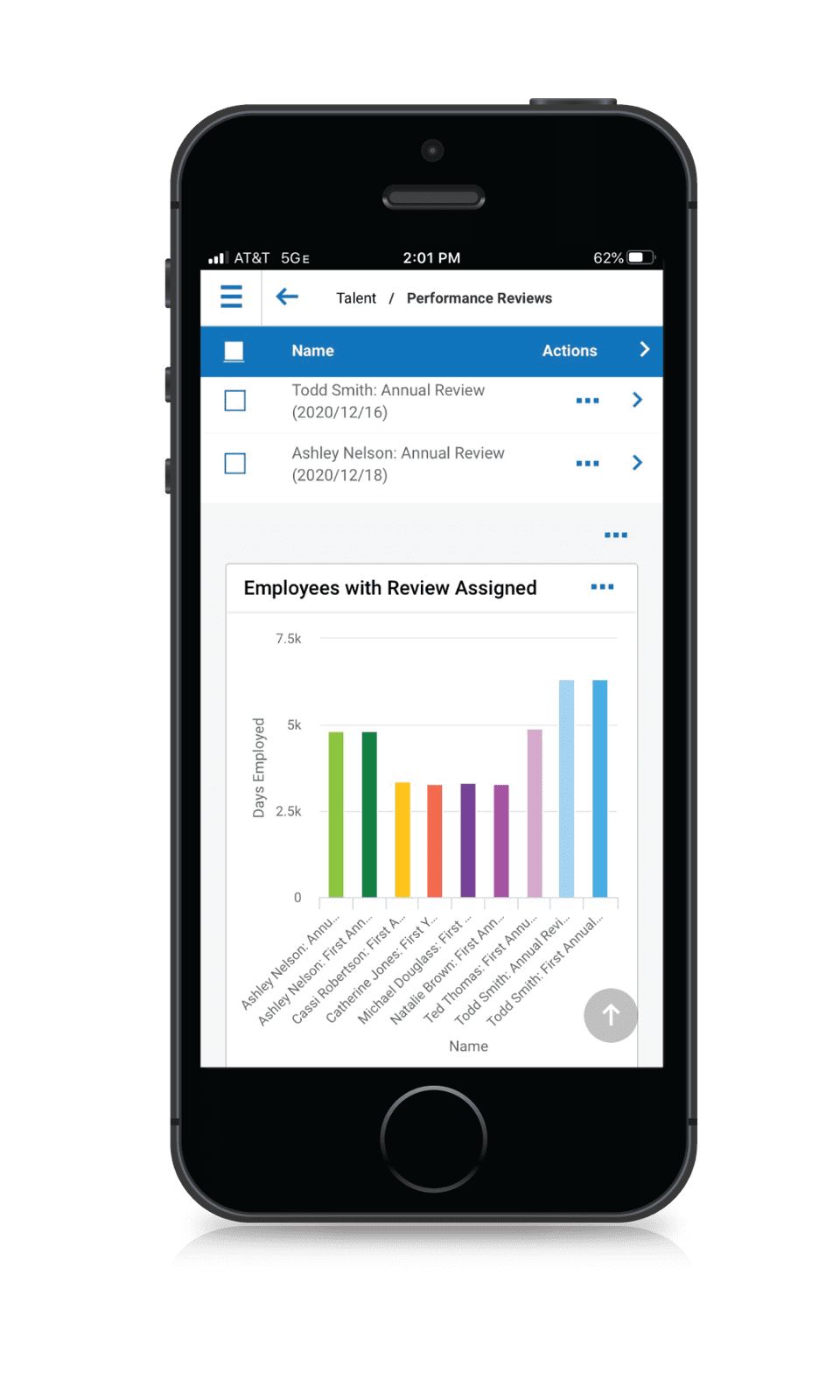

Performance Management

With continuous performance review functionality that takes into consideration company and personal goals, you won't skip a beat on evaluating performance even during remote work scenarios.

3 Tips to Make Online Training Successful Long Term

Online trainings can be a useful tool for developing talent, but they can also end up being a waste of time and resources, even if the content and presentation are good. The difference between effective and ineffective training often comes down to whether employees are able to absorb and retain the information they receive.

There are lot of obstacles to absorption and retention of trainings. Busy employees may listen to a webinar while they work on other things, catching only tidbits here and there. Or they may put a training video off until they’ve finished a project and are too exhausted to give it due attention.

To avoid these training pitfalls, consider these three tips:

Follow the AGES Model

The NeuroLeadership Institute argues that we learn quickly and retain information best when we focus on one topic (attention), actively connect what we learn to what we already know (generation), experience positive feelings while learning (emotion), and space our intake of information (spacing). For example, cramming training on multiples topics into a tight two-day workshop would be much less effective than spreading that training out over a few weeks. You can learn more about the AGES Model here.

Give Employees Time to Reflect and Practice the Skills They've Learned

In some professions, like music and athletics, you spend most of your work time learning, building, and reinforcing skills before the big performance, whether it’s a concert, game, or race. Good performance necessitates constant practice. But in most professions, practice seems like a luxury you can’t afford because you’re expected to be performing during your work time. This is one reason trainings fail to deliver results. To master new skills, employees need time to focus on building those skills. That means some work time needs to be set aside post-training for them to reflect on and practice what they’ve learned.

Align Trainings with the Present Needs and Future Goals of Both the Company and the Employee

When assessing employee training goals, consider what additional knowledge and skills would enable them to do their jobs better now, but also set them up for success in their future careers. Employees are more likely to be excited by and personally invested in their training if they understand their personal return on that investment. If they don’t recognize its value, it won’t have any value to them.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Leading During a Pandemic

No one knows what the workplace is going to look like in three months. COVID-19 continues to spread. School reopening and attendance plans remain tenuous. Further action from Congress is uncertain. Official rules from the Department of Labor might even be struck down in court, further adding to the confusion about what employers are supposed to be doing.

Leading an organization right now can feel like driving to a destination you’re not sure exists on a road that’s changing right before you.

In this situation, we need to accept that the typical ways of leading a team may not prove successful. The simple question of what success looks like right now isn’t easy to answer with either clarity or consistency. For instance, conventional wisdom around goal setting says that goals should be specific, measurable, attainable, relevant, and time-bound (SMART goals). But the pandemic has made it much more difficult to pin any of these down. Think of the movie studio executives attempting to calculate the risks of releasing a feature film on a streaming service instead of in movie theaters. Or grocery store employees trying to mandate mask wearing and social distancing when some vocal customers don’t want to cooperate. What success looks like in these situations is not at all clear.

While it’s unlikely that leaders can bring true clarity and certainty to the present moment, there are leadership practices that can help promote the well-being of the organization and its people. We recommend the following:

The Struggle to Hire and What Businesses Can Do About It

If you’re finding it difficult to hire employees, you’re not alone. Bloomberg reports that many small businesses are struggling to find people who currently want to work—in fact, 42% say they have jobs they can’t fill. The number of people quitting jobs right now is also higher than average.

One culprit is likely COVID-19. For reasons related to the pandemic, a number of people are choosing not to work right now. They don’t want to risk getting sick, they have children at home, or they may be able to get by for now on unemployment insurance.

Some small businesses with positions to fill have turned to gimmicks like signing bonuses and free food, but these recruiting tactics are unlikely to be effective long term. They don’t address the risks, challenges, and needs people have right now.

Fortunately for employers looking to hire, the problem of people choosing not to work isn’t fundamentally different than the problem of people choosing to work somewhere else. In both cases, the would-be employer has to convince prospective hires that working for them is better than the alternatives, and then they have to live up to those promises.

To be sure, those who choose not to work are missing out on many benefits. A job provides not only a paycheck, but also opportunities for employees to do meaningful work, contribute to their community, make friends, develop skills, receive training, advance their career, and fund their retirement. If someone isn’t working, they’re missing out on these and other opportunities. Employers may be able to leverage these benefits to appeal to those who have removed themselves from the workforce and convince them that work is worth it.

Safety, Flexibility, and Pay

Before employers can use benefits like friendship and skill-building to lure applicants, they must first address safety, flexibility, and pay; in a hierarchy of employment needs, these are foundational.

While vaccinations are proceeding at an encouraging rate and all adults are now eligible, COVID-19 remains a serious threat. It will be some time before people getting their shots now develop immunity to the virus, and they may worry about infecting friends and family who are unable or unwilling to get the vaccine. Because of these fears, some people aren’t going to work, period, and there’s nothing employers can do to persuade them. Others, however, may be open to working if they feel confident enough that the job won’t put them or those they care about in danger.

Flexibility is another key component for many potential applicants, much more so now that in-person school and childcare have become scarce. Since younger children cannot be left to fend for themselves while parents are at work, something has to give. Employers that provide flexibility—either through the initial scheduling of shifts or the ability to rearrange working hours on the fly—will likely receive more applicants and have a lower rate of turnover.

Other potential employees may be willing to work if they feel the pay is worth the risk and sufficient to cover the costs of working (transportation, childcare, insurance premiums, etc.).

Of course, most businesses don’t relish the idea of paying employees higher-than-usual wages, but there’s good reason to believe that increased pay is a good investment, especially for people in traditionally lower-paying jobs. When people are preoccupied with bills, debts, and other forms of scarcity, they tend to be less productive and make more mistakes. But, when scarcity isn’t taxing their mental bandwidth, they’re able to be more productive, make fewer mistakes, and increase business profitability. Increases in pay can pay for themselves.

Career Development Opportunities

It may be that the positions an employer needs to fill don’t come with an exciting career path or teach the kind of skills that employees are likely to put on future resumes. But that’s not set in stone. Both the employer and the employee choose what skills are learned and used in every position.

Imagine, for a moment, a local deli that needs to hire a person to take orders at the register. The job market might consider this job “low skill,” but the owner of this deli doesn’t think of the job that way or advertise it that way.

Now, the owner doesn’t use the gimmick of giving the job a fancier title than what it entails; instead, they set the job up to provide skills training for more advanced positions in customer service or sales. In the first few days, the new hire will learn the menu and the layout of the register, but then, in the lulls between rushes, they’ll learn techniques for talking to customers, de-escalating tense situations, upselling, and the like—training that people in customer service and sales would expect to receive. Later, the new hire might even learn some of the ins and outs of starting and running a small business.

This owner knows that high employee turnover is simply the nature of the business and that employees will, sooner or later, take their training and skills to other jobs. And that’s the point. The aim here is to cultivate a reputation in the community as an excellent place for customers to grab a meal and an excellent place for employees to start learning marketable skills they’ll use throughout their careers, increasing the size of both the applicant pool and the deli’s profits.

Attractive Job Postings & Hiring Processes

Poorly written job postings can prove a serious obstacle to getting applicants. It’s important, as Katrina Kibben reminds us, that recruiters and hiring managers understand what they’re looking for in a new hire and write job postings that are simple and effective.

If an employer offers some or all of the benefits discussed above, they should showcase them in their postings with concrete examples and as part of an engaging story. For instance, instead of the deli owner writing, “We teach valuable skills,” they can explain that down time will be filled with instruction on sales and de-escalation techniques. And instead of saying, “We offer flexibility,” an employer can advertise that employees have of a range of shifts to choose from on a weekly basis, or will be able to complete their work at any time of day, so long as weekly deadlines are met.

But no amount of training opportunities will mean a thing if a business’s hiring process is a chore for applicants to get through. The more minutes it takes to complete an application, the more applicants will decide it isn’t worth it. The longer a candidate has to wait for an offer, the more likely they’ll turn down that job offer—sometimes, as Adam Karpiak illustrates, even when they don’t have another job lined up.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Support the Mental Health of Your Employees During COVID-19

When social distancing and self-quarantine are needed to limit and control the spread of the disease, continued social connectedness to maintain recovery are critical. Access vital virtual recovery resources below!

CDC Guidance for Reopening Buildings

As office buildings begin to reopen, employers can take steps to create a safe and healthy workplace and protect workers and clients. The CDC recommends starting by creating a COVID-19 workplace health and safety plan.

Resuming Business Toolkit: COVID-19

This toolkit, provided by the CDC, is designed to assist employers in slowing the spread of COVID-19 and lowering the impact in their workplace when reintegrating employees into non-healthcare business settings.

Give Your Employees Access to Their Earned Wages Before Payday!

Allow employees still working during COVID-19 to access their wages before payday. The system looks at daily pay vs. time worked along with maximums you set to determine how much pay can be taken ahead of time. Simply download the app! No interest, monthly maintenance or usage fees. Once an employee signs up and pushes earnings ahead of check-date, funds will be made available on a VISA debit card with no fees for: POS transactions, ATM transactions, account transfers, or online transactions.

Sample Employee Notice- Face Coverings

Note to employers: State and local laws and orders may provide different or additional requirements for employers regarding masks or face coverings, including guidance on whether employers must provide and pay for them, who must maintain and clean them, and more. Review applicable mandates to ensure compliance.

Help Bring Your Employees Back to Work Safely: COVID-19 Digital Screening

A Company Nurse Solution

Safely and confidently ease your team back to the workplace with COVID-19 digital screening and triage guidance! Screen employees before they return to the workplace with the most up-to-date CDC guidelines, so you can be sure that they are healthy and ready to return to the workplace!

Sample Welcome Back Letter

Welcome your employee's back to work and acknowledge the changes you have made to further ensure workplace safety and protocols. Access a sample letter below. Be sure to adjust language as necessary and check state & local public health guidance as you formulate return to work plans for your organization.

Pandemic Response Training Courses

Available Now!

Ensure you and your team have the right tools to navigate uncertainty by having access to pandemic response training's. Ten courses are available and range from managing in a crisis to forging ahead with perseverance and resilience!

Guidance on Preparing Workplaces for COVID-19

Access OSHA's guide below to assure safe and healthful working conditions as you reopen the workplace.

Key Practices to Keep the Workplace Safe

Create and Issue a Written Safety Policy

Create and issue a written safety policy for employees to read and acknowledge. Employees should know that they will be held accountable to the policy and can be disciplined regardless of whether they sign it.

Provide Employees with a Form

Provide employees with a form (either paper or digital) so they can document and report their safety concerns. This promotes employee involvement in proactive safety assessments of the workplace. For this practice to work, employees need to feel comfortable raising concerns and confident those concerns will be addressed. You can make the submission process anonymous to increase the likelihood that it is used.

Avoid Keeping Safety Violations Hidden

Do not create safety incentive programs or reward employees when there are no reported incidents, as these rewards can encourage employees to keep safety violations hidden.

Provide Hassle-Free Paid Sick Leave

Provide paid sick leave and make requesting leave hassle-free. When sick employees are worried about a smaller paycheck or are required to find a substitute to cover their shift, they may feel pressured to come in to work while infectious, putting colleagues and customers at risk.

Promote Psychological Safety

Promote psychological safety by taking steps to ensure people feel safe to speak up about their concerns.

Allow Employees to Rest & Recharge

Give employees permission and time to rest and recharge. When a workplace situation causes someone to have a fight-or-flight response, it may be best for them to step away from the situation before they say or do something they may regret or that causes more harm. Make sure employees know that they can remove themselves from an overly stressful situation, without punishment or retaliation.

Forward OSHA's QuickTakes

Newsletter

Forward OSHA's QuickTakes online newsletter to employees.

Offer Monthly Safety or Wellness Trainings

Offer monthly 10-minute safety or wellness trainings. Trainings could be on anything from how to get a good night’s sleep to safe driving techniques. Promote employee involvement by asking various employees to facilitate them.

Talk to Your Worker's Compensation Carrier

Talk to your workers’ compensation carrier. You can get good safety tips, trainings, and ideas from them, and you may be able to get write-offs. Like you, they want to keep costs down, so they’ll likely appreciate your efforts to make safety a priority and do what they can to help.

How to Help Employees Communicate More Effectively

In an ideal world, communication would be easy. We'd immediately know exactly what to say or write. Emails, Slack messages, and reply threads would practically write themselves. And there'd be no confusion about what anyone meant, ever.

Of course, communication never works that way. We stare at the computer screen trying to decide how to begin an email. We misspeak or garble our words. We don’t always convey exactly what we intend. We misunderstand, overlook, or forget information we’ve been given. We also sometimes read emotions into words that weren’t what the writer was feeling. Or we pack our speech with such an emotional punch that it distracts from the point we’re trying to make.

Written communication often exacerbates these issues, a fact that has many leaders worried since more people are working remotely and relying on the written word to do their jobs. It's

no secret that we spend far too much time on email and other communication tools.

Fortunately, you don’t necessarily need to hire a writing coach to teach your employees better writing skills—although this can in some cases be a good idea. You can significantly improve communication in your organization by asking your employees to consider the following practices in their written communications:

Break up long sentences and paragraphs.

A big unbroken block of text is likely to befuddle your reader before they even get to the first word. Long sentences and paragraphs also make comprehension and retention of information much more difficult. Note the differences in these two communications:

Sample 1: I support the goals outlined in the proposal you sent to me yesterday, especially the need to better define appropriate metrics around the solicitation of customer satisfaction scores, and I want to thank you for the thought you gave to proposing workable solutions, but I’m not sure if all of the proposed solutions will work at this time. Let’s discuss it all at our next check-in.

Sample 2: Thank you for sending the proposal yesterday. I appreciate the thought you put into it. I agree with you about the goals, especially what you wrote about customer satisfaction scores. The solutions you proposed, however, may be a challenge to implement right away. Let’s discuss the proposal at our next check-in.

These samples provide the same information, but the second is easier to follow and digest.

Avoid unnecessary details.

While some context is useful, too much can overwhelm the reader and add to the time it takes for the communication to be written, read, and acted on.

Sample 1: I ran into Lindsay in the lunchroom and asked her about the Paterson deal. She asked me to follow up with her after her lunch break, which I did, and she gave me permission to start on the outline. She seemed a little aggravated that I interrupted her lunch. Anyway, I need to respond to a few emails before I get started on it, but I will get to it after and have it to you and her by close of business today.

Sample 2: I got the go ahead from Lindsay on the Paterson deal. I’m working on the outline and will email it to you and her by close of business today.

The first sample likely has too much information. The writer may have felt like including the extra details because they felt bad about asking Lindsay to work on her lunch break, but unless there’s a good reason for the recipient to know those details, they’re best left out.

Use clear, concrete terms.

Vague words, convoluted ideas, and broad generalizations make for easy miscommunication. Your reader will be more likely to understand your meaning if your language is specific. Remember too that just because something is clear to you doesn’t necessarily mean it will be clear to your reader. Compare these two statements:

Sample 1: Would you be able to review the thing I sent you earlier?

Sample 2: Here’s the letter for Anil I told you about this morning. Would you be able to proofread it for typos by the end of the day?

The first sample is likely to cause confusion and frustration if the recipient has recently received a lot of “things” from the writer or other people. In contrast, the second sample makes the context and the requested task clear to the reader.

Save difficult or emotionally intense conversations for calls, video conferences, or in-person meetings.

These conversations usually require more finesse than written text can provide. If you anticipate a strong emotional response to what you have to say, or if you believe the person with whom you’ll be communicating may read strong emotions into what you have to say, don’t write to them. Talk it through instead. Let them hear your voice and listen carefully to theirs.

Provide context and direction when adding someone to a conversation.

Most of us have had the experience of receiving a forwarded email that we’re not immediately sure what to do with. Should we keep it as a reference? Read through the thread? Respond in some way? We haven’t been told. Don’t do this. You should clue the reader in to what the conversation entails and what they need to know and do in response. Compare:

Sample 1: Please see below. What do you think?

Sample 2: Please read through the conversation below and note the product request from Oliver. Is that something you can add to your work this week?

The first sample is likely to prompt the recipient to weigh in on the wrong subject or ask the writer for clarification before responding, wasting valuable time either way. The second sample gives clear instruction, saving time.

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

Four Steps to Take When an Employee is Diagnosed with COVID-19

As COVID-19 infection rates continue to climb, it's imperative that organizations respond quickly when an employee is diagnosed. Here are the steps employers should take:

Notify Employees

Employees should be notified of potential exposure in the workplace, but they should not be told who is sick. Employees won't like that they can't gauge their own risk, but the ADA requires this type of information remain confidential. Don't worry if employees figure it out on their own, but make sure you're not the one to reveal the information.

Assess the Risk

If there was close contact for a prolonged period (about six feet or less for 15 minutes or more over the course of 24 hours), exposed employees should quarantine. If you aren't confident in your risk assessment, call your local or state health authority to help you determine which employees should quarantine.

Disinfect Areas

The CDC recommends the following practices:

- Close off areas used by the person who is sick for 24 hours, if possible.

- Open outside doors and windows to increase air circulation in the area.

- Clean/disinfect areas and items used by the person who is sick.

Determine When

Sick employees should work with their healthcare provider to determine when to return to the workplace. Generally, an employee will be okay to return when at least 2 hours have passed since resolution of fever without the use of medication, and other symptoms have improved, and at least 10 days have passed since symptoms first appeared or since the positive test result, if the employee is asymptomatic.

Back-to-School: Frequently Asked Questions about Leave under the Families First Coronavirus Response Act (FFCRA)

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.

No. 1: Employers will shift from managing the employee experience to managing the life experience of their employees.

According to Gartner's 2020 ReimagineHR Employee Survey, employees reported better (over 20%) mental and physical health when employers supported their life experiences. Supportive employers also saw an increase in the number of high performing employees.

No. 2: More companies will adopt a stance on societal and political issues.

2020 Gartner research shows that 74% of employees expect their employer to be more actively involved in cultural debates. They are predicting that CEOs will have to be more responsive in order to retain and attract top talent.

No. 3: The gender-wage gap will continue to increase as employees return to the workplace.

A recent survey revealed that 64% of managers believe in-office employees perform higher than remote workers. A 2019-2020 Gartner survey gathered just the opposite where full-time remote workers were 5% more likely to perform higher than full-time in-office employees. If managers continue to retain a bias toward in-office employee's and if men are more likely to work from the office, it's possible to see managers over-rewarding those employees.

No. 4: New regulations will limit employee monitoring.

A result to the pandemic has led organizations to implement new technology to passively track and monitor their workforce. Many of these companies have yet to determine how to balance employee privacy with the technology, increasing employee frustration. Gartner predicts that in 2021, new state and local regulations will begin to put limits on what employers are able to track.

No. 5: Flexibility will shift from location to time.

Gartner's 2020 ReimagineHR Employee Survey revealed that companies with flexibility regarding when, where and how much employees worked, had a high performing workforce of 55% in comparison to organizations with a standard 40-hour work week (36%).

No. 6: Leading companies will make bulk purchases of the COVID-19 vaccine for employees- and will be sued over COVID-19 Vaccine Requirements.

Some employers will use the COVID-19 vaccine as a differentiator to attract and retain talent. Gartner predicts that in tandem, those that make the vaccine a requirement may later be sued.

No. 7: Mental health support will expand.

Self-care and the importance of mental health has been emphasized more than ever. Gartner predicts that employers will expand mental health benefits and introduce "collective mental health days".

No. 8: Employers will "rent" talent to fill the skills gap.

In an effort to meet changing needs, employers are listing more skills on job requisitions. Some companies will pay a premium for those skills and others will expand their use of contingent and contract hiring.

No. 9: Jurisdictions will compete to attract talent rather than trying to get companies to relocate.

The new era of remote and hybrid work means that where an employee lives will be less tie to where their employer is located. This break in where employees live and where they work will lead states and cities to start using their tax policies to incentivize talent to relocate to their jurisdiction rather than giving tax credits to large companies to relocate.

Gartner 2021. Brian Kropp. https://www.gartner.com/smarterwithgartner/9-work-trends-that-hr-leaders-cant-ignore-in-2021/

Legal Disclaimer: Payroll Experts is not engaged in the practice of law. The content in this article should not be construed as legal advice, and does not create an attorney-client relationship. If you have legal questions concerning your situation or the information you have obtained, you should consult with a license attorney. Payroll Experts cannot be held legally accountable for actions related to this receipt.